In today’s hyper-visible markets, narratives—not just numbers—move capital. Financial institutions are exposed to risks that don’t appear on balance sheets: backlash against ESG stances, pricing decisions amplified through social pressure, and misleading claims that ripple through investor networks and online forums.

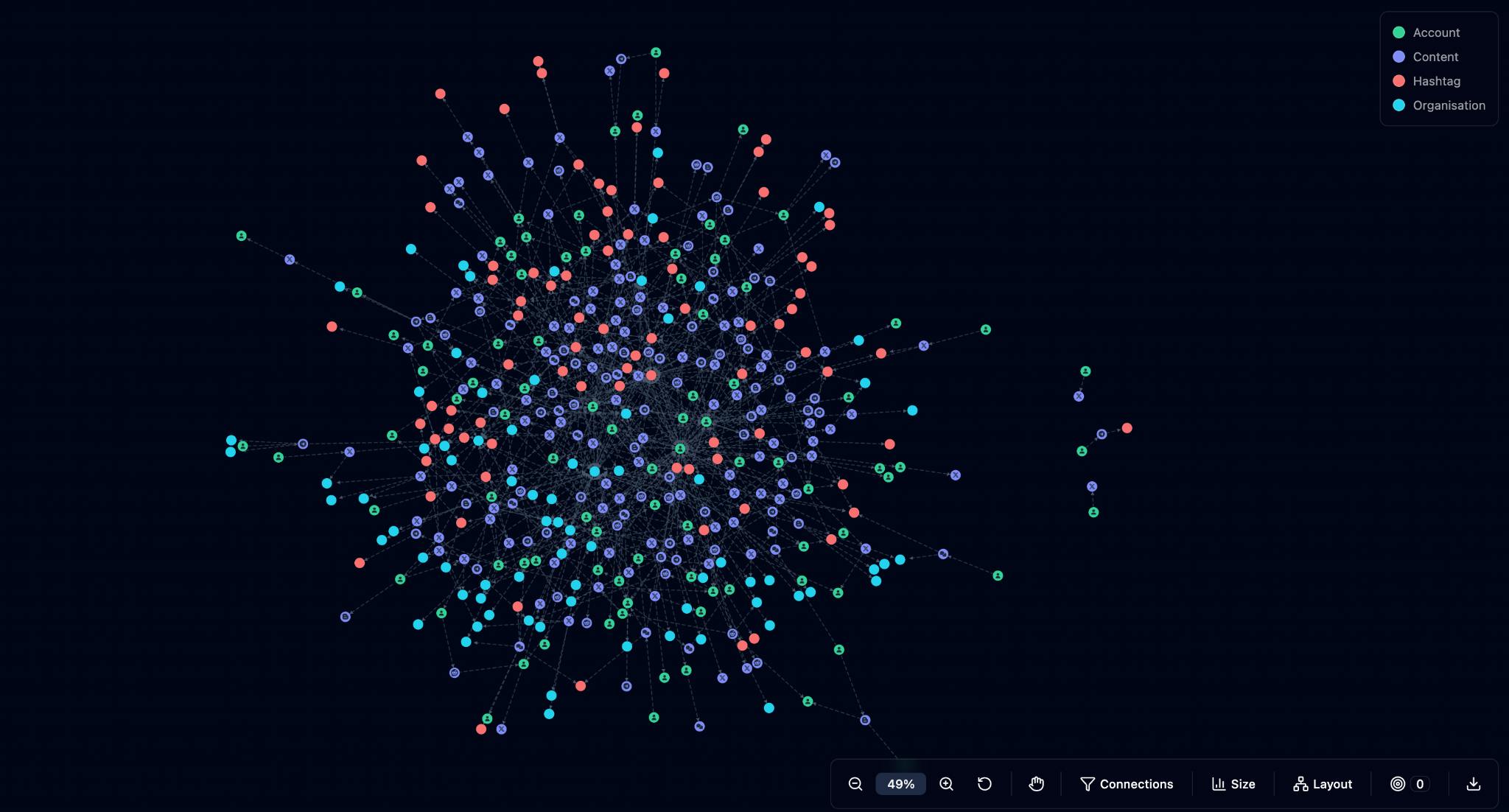

Logically provides the foresight financial organisations need to manage these risks before they escalate. Our platform tracks how narrative pressure builds across the digital ecosystem—surfacing early signals of reputational threats, public scrutiny, boycotts and even targeting of executives or staff.

We don’t just show you what people are saying—we show you which stories are gaining traction, who’s behind them, and what they might mean for trust, value, and operational stability. Whether it’s sentiment turning on a policy announcement or narrative build-up ahead of shareholder pressure, Logically enables faster decision-making backed by narrative intelligence.

Key Benefits of Working with Logically

Narrative-Led Market Risk Detection

Uncover emerging storylines—around policies, leadership, or industry developments—that influence investor sentiment and market positioning ahead of volatility.

Reputation and Brand Trust Intelligence

Track how your institution is being discussed across mainstream and fringe platforms. Identify criticism, misleading claims, and mounting scrutiny early enough to shape your response.

Staff and Executive Exposure Awareness

When individuals within your organisation are referenced or targeted in digital spaces, Logically highlights risk trajectories—supporting both corporate protection and staff well-being.

Use cases

Early Warning for Market and Sentiment Volatility

Detect shifts in public tone around financial trends, geopolitical events, or leadership decisions—helping strategy and risk teams stay ahead of market sentiment.

Reputation Management in High-Visibility Moments

Monitor perception of your institution’s positioning during product launches, rate changes, ESG updates, or external events—before negative narratives take hold.

Executive and Staff Safety Monitoring

Identify when leaders or staff become focal points in critical discussions, especially in fringe platforms—enabling timely risk mitigation and appropriate internal support.

Discover How It Works

Logically’s platform tracks and interprets emerging narratives across the public information environment. For financial institutions, this means foresight into reputational risk, visibility into market shifts, and early signals that support more resilient decision-making.

Our Latest Resources

With advanced AI-driven research and deep subject-matter-expertise, Logically provides in-depth foresight to address today’s most pressing information challenges. Explore some of our investigations to see the power of Logically Intelligence in action.

AI on the Record - Podcast Series Hosted by Jennifer Woodard

8/22/2025AI on the Record is a conversation series for leaders navigating an era where artificial intelligence shapes markets, narratives, and national security. Hosted by Jennifer Woodard, VP of AI at Logically and former AI founder and EU advisor, the series brings together voices from policy, enterprise and civil society to unpack where influence is going, how AI is being governed, and what decision-makers should be paying attention to next when it comes to the information environment.

Weaponized Weather: When Disasters Become Information Battlegrounds

8/20/2025

From Online Narratives to Offline Attacks: How Logically Helps Detect the Threat

7/31/2025

HEAT: Harmful Environmental Agendas & Tactics - A look at France, Germany, and the Netherlands

6/23/2025

Schedule Your Consultation

Speak with our team about how Logically helps financial institutions stay ahead of market volatility, narrative escalation, and reputational exposure. Complete the form.